vermont income tax rate 2021

They vary based on your filing status and taxable. This form is for income earned in tax year 2021 with tax returns due in.

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Find your income exemptions.

. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. Tuesday January 25 2022 - 1200. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Your average tax rate is 1198 and your marginal tax rate is. Vermont has four state income tax brackets for the 2021 tax year. Provided the state does not have any outstanding Title XII loans payment of state unemployment taxes in a timely manner reduces the federal unemployment tax rate from 60.

Meanwhile total state and local sales taxes. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. 2019 VT Rate Schedules.

For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. 2020 VT Rate Schedules. We last updated the Income Tax Rate Schedules in March 2022 so this is the latest version of Tax Rate Schedules fully updated for tax year 2021.

We last updated Vermont Tax Rate Schedules in March 2022 from the Vermont Department of Taxes. Tax rate of 875 on taxable income over 204000. Vermont Income Tax Calculator 2021.

2021 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. This form is for income earned in tax year 2021 with tax returns due in April 2022. Detailed Vermont state income tax rates and brackets are available on this page.

Tax rate of 76 on taxable income between 97801 and 204000. 2019 VT Tax Tables. Tax Year 2021 Personal Income Tax - VT Rate Schedules.

We last updated Vermont Form BA-410 Instructions in October 2022 from the Vermont Department of Taxes. Vermont also has a 600 percent to 85 percent corporate income tax rate. For married taxpayers living and working in the state.

If you make 70000 a year living in the region of Vermont USA you will be taxed 12902. Find your pretax deductions including 401K flexible account. 2021 Income Tax Withholding Instructions Tables and Charts.

RateSched-2021pdf 3251 KB File Format. They vary based on your filing status and taxable income. Vermonts tax system consists of a state personal income tax estate tax state sales tax local property tax.

How to Calculate 2021 Vermont State Income Tax by Using State Income Tax Table. 2020 VT Tax Tables. You can download or print current or past.

Here you can find how your Vermont based income is taxed at different rates within the given tax brackets. Compare your take home after tax and estimate.

State Sales Tax Rates 2022 Avalara

Vermont House Gives Tentative Green Light To 1 200 Child Tax Credit Vtdigger

Sanders Rolls Out Nearly 3 Trillion In Tax Increase Proposals Roll Call

Service Tax Study Prompts Alarm The White River Valley Herald

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Personal Income Tax Department Of Taxes

Top States For Business 2021 Vermont

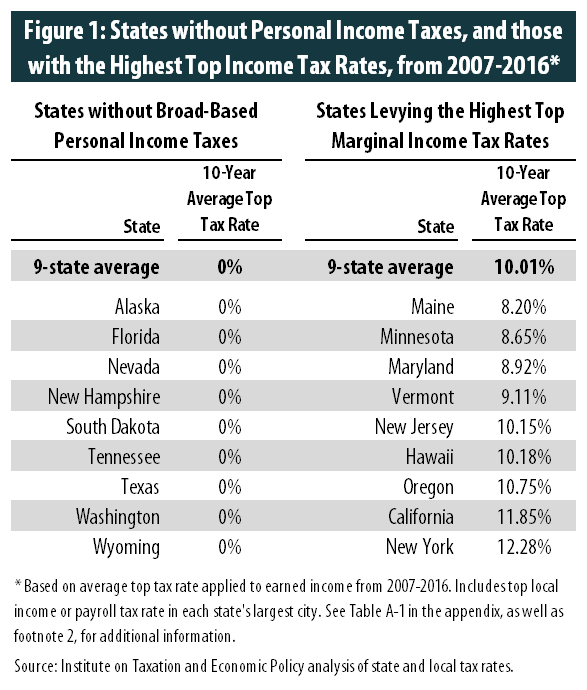

States Without Personal Income Taxes Are Not Seeing Greater Economic Growth Than States With Highest Income Tax Rates West Virginia Center On Budget Policy

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

States With The Lowest Taxes And The Highest Taxes Turbotax Tax Tips Videos

New Report Vermont S Tax System Is Among The Least Regressive Public Assets Institute

2022 Capital Gains Tax Rates By State Smartasset

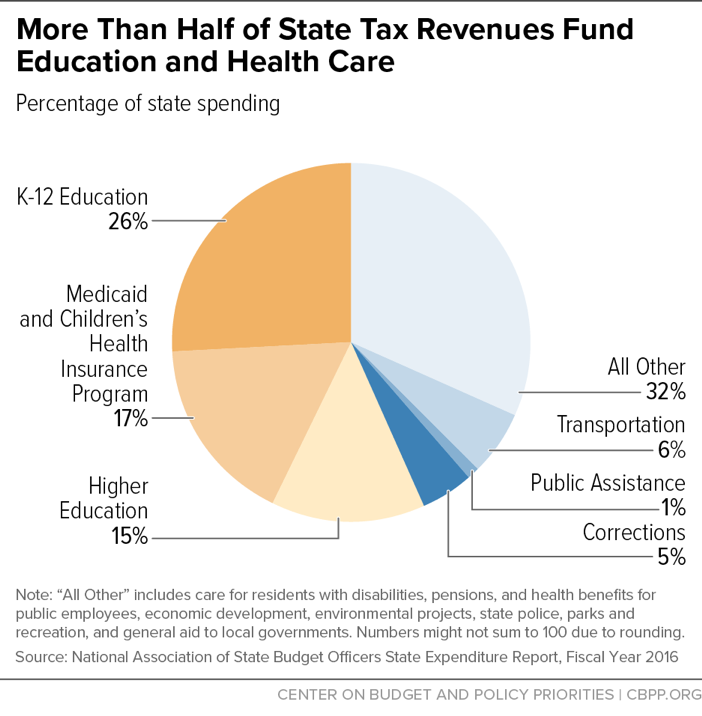

Policy Basics Where Do Our State Tax Dollars Go Center On Budget And Policy Priorities

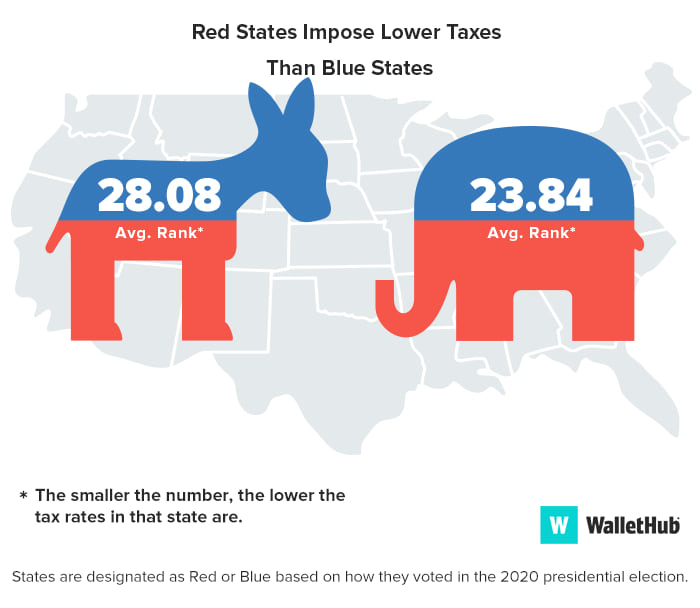

States With The Highest Lowest Tax Rates

Vermont Corporate Income Tax Rate 12th Highest Vermont Business Magazine

Vermont Property Tax Rates Nancy Jenkins Real Estate

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont State Tax Guide Kiplinger

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation